The worst decision Scotland can make right now is to become independent post-Brexit, when you look only at the economic arguments.

Britain may have voted for Brexit on June 2016 and the Scots may be upset about it – but that does not change how the Scottish economy operates or what European officials have said about the hoops Scotland will have to go through if it were to sever its more than 300-year union with the United Kingdom.

On September 19, 2014, 55.3% of Scots voted for Scotland to stay part of the UK in an independence referendum. In 2016, while 51.89% of Britain voted for Brexit, a majority of Scots, 62% with 1,661,191 votes, opted to remain part of the EU.

So, understandably, Scotland may feel that the majority of the country is not being represented in Britain’s overall Brexit plans. After all, Prime Minister Theresa May is not just ushering the nation into a Brexit, she is going for a “hard Brexit” – the UK leaving the Single Market in lieu of full control over immigration.

The First Minister of Scotland Nicola Sturgeon said on Monday that she intends to trigger another Scottish referendum even before Brexit has occurred, from between Autumn 2018 and Spring 2019.

Prime Minister May is expected to trigger Article 50 on Tuesday, thereby starting the formal two-year negotiation process on Britain leaving the EU. Even if she triggered Article 50 tomorrow, it would take at least two years for Brexit to happen. Eurogroup President Jeroen Dijsselbloem said negotiations over Brexit are very complex and are going to take longer than the scheduled two years.

So Sturgeon wants Scotland to make a decision on becoming even more isolated without even seeing the final deal Prime Minister May makes over Brexit.

Look what Scotland has been told in the past by EU officials, and how the economy operates, and it's clear that all Scotland would do is make itself implode.

The key part of its economy is dying

Oil is the jewel in the crown for Scotland's economy. The National Institute of Economic and Social Research (NIESR) figures show that the North Sea contributes around £10 billion to the Scottish economy.

Around two thirds of the North Sea oil industry's profits and employment are conducted in Scotland.

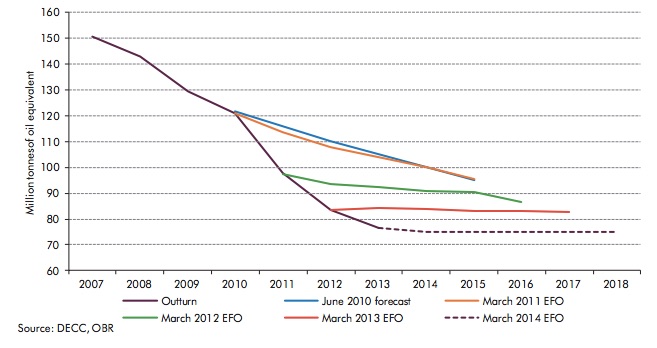

But Scotland's oil reserves are dying, and it faces a huge bill related to decommissioning - when companies dismantle and remove structures for oil and gas operations that are no longer in use.

Oil prices have tumbled precipitously since June 2014 from over $100 per barrel to as low as $20 per barrel at one point last year. It has slightly recovered since then but it is still struggling to break the $50 per barrel mark or move upwards:

Back in 2015, Bank of England Governor Mark Carney warned that the oil price plunge alone is estimated to hit Scottish GDP by £6 billion over 2016. After all, if a company produces oil but the margins are squeezed and therefore making less money, less tax revenue will enter the economy.

While former Chancellor George Osborne cut taxes for oil companies in a bid to help out them out, this has not been enough to keep companies investing and expanding - oil prices are too low and reserves are dwindling. Do not forget, these are tax breaks generated from Westminster.

We have already seen BP and a range of other energy giants cut jobs.

In 2014, OPEC laid out how the North Sea oil industry is in dire straits. The average oil output in 2013 from the North Sea clocked its lowest level since 1977.

On top of that, North Sea oil faces a ticking timebomb that is going to cost the country £24 billion overall - the issue of decommissioning.

According to energy research group Wood Mackenzie, decommissioning aging infrastructure in the North Sea is something that will be mandatory in a few years time. One of the biggest issues surrounding this is about who is going to foot the bill.

Wood Mackenzie said that on its current projections, it will cost the Treasury 50% more than what it originally forecasted at £16 billion. This is because oil companies are set to spend £53 billion from 2017 but claim back almost half of this through tax relief.

In other words, while oil companies are set to pay for decommissioning, the taxpayer will bear a large brunt of the costs because the energy groups will get their money back through beneficial tax reliefs.

If Scotland breaks away from the UK, the rest of Britain will not foot the bill - it will be the Scots. Considering the North Sea is not exactly the most attractive place to invest and expand right now, this could kill it off.

Scotland's spending is one of the worst in the UK

Out of Scotland's tax revenue around 10-20% is generated from oil. Oil only accounts for 1.5% of Britain's overall tax revenue.

The services industry accounts for over 75% of Britain's economy. Last year, it reached nearly 80% of GDP.

The UK's financial services sector alone - mostly in London- contributed £71.4 billion in tax in 2015 and accounted for 11.5% of Britain's total tax receipts. In July last year, a Centre for Cities study also said that London generates almost as much tax as the next 37 largest cities combined.

This is what allows the government to fund smaller parts of the economy, give tax breaks, and fund welfare.

At the moment, "30% of all government spending in Scotland and 11.4% of GDP (including a geographical share of North Sea output)" is for "benefit spending (including spending on tax credits and the state pension)," according to the Institute for Fiscal Studies.

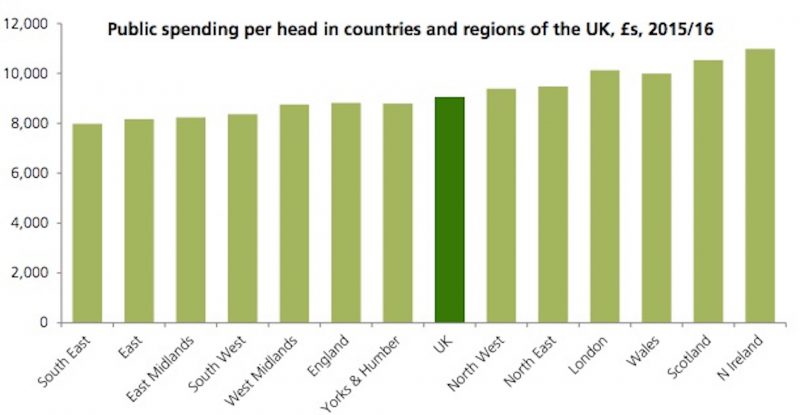

In November 2016, the IFS laid out public expenditure by country and region, per head:

Scotland's professional services companies are unlikely to stick around

So if Scotland was to depend on just its own economy to support its citizens amid the downturn in oil it will face serious problems.

On top of that, while it does have a vibrant professional services economy, companies are already making contingency plans post-Brexit - and they are not looking to relocate to, or possibly stay in, Scotland.

Scotland's financial services industry employs 150,000 people.However, Scotland's key corporates already say they are looking to move staff to somewhere within the EU.

Standard Life said two years ago that it would look to move outside of Scotland if it became independent. It has around 5,000 staff in Scotland. It manages more than £244 billion in assets and around 90% of clients are based outside Scotland. It warned the country that it might move staff and resources out in the event of independence, because of the uncertainties surrounding regulation, a currency union and its European Union membership.

May has said she wants to take Britain out of the EU Single Market, which will result in the loss of passporting rights that allow finance companies to sell services across the 28-member bloc. This could have a devastating effect on Britain's financial and professional services industry.

Major investment banks such as JPMorgan and UBS have publicly warned that they will have to move jobs out of the UKand to mainland Europe. A Brussels think tank estimated earlier this year as many as 30,000 jobs could move as a result.

Last year, banks voiced their concern that Brexit could see the end of the Royal Bank of Scotland because not only would it have to deal with the economic fallout like the rest of the sector, it is also uniquely placed in suffering from a second potential Scottish independence referendum after that.

Yes - Scotland will have to reapply for EU membership

Throughout the first round of Scottish independence campaigning, the "Yes" campaign repeatedly promised two things to voters:

1. It would retain the sterling as a currency.

2. It would still be part of the EU.

Yet UK and EU officials repeatedly said that these elements would not be automatic and would actually be "impossible."

It is unlikely that Scotland would retain the pound if it opted for independence from the UK. And if it has to reapply for EU membership, then it is unlikely it can just take the euro either.

An independent Scotland will have to face an incredible amount of uncertainty without the strength of the Union to help. And this is all before citizens get to know about the final agreement on Brexit.